Introduction

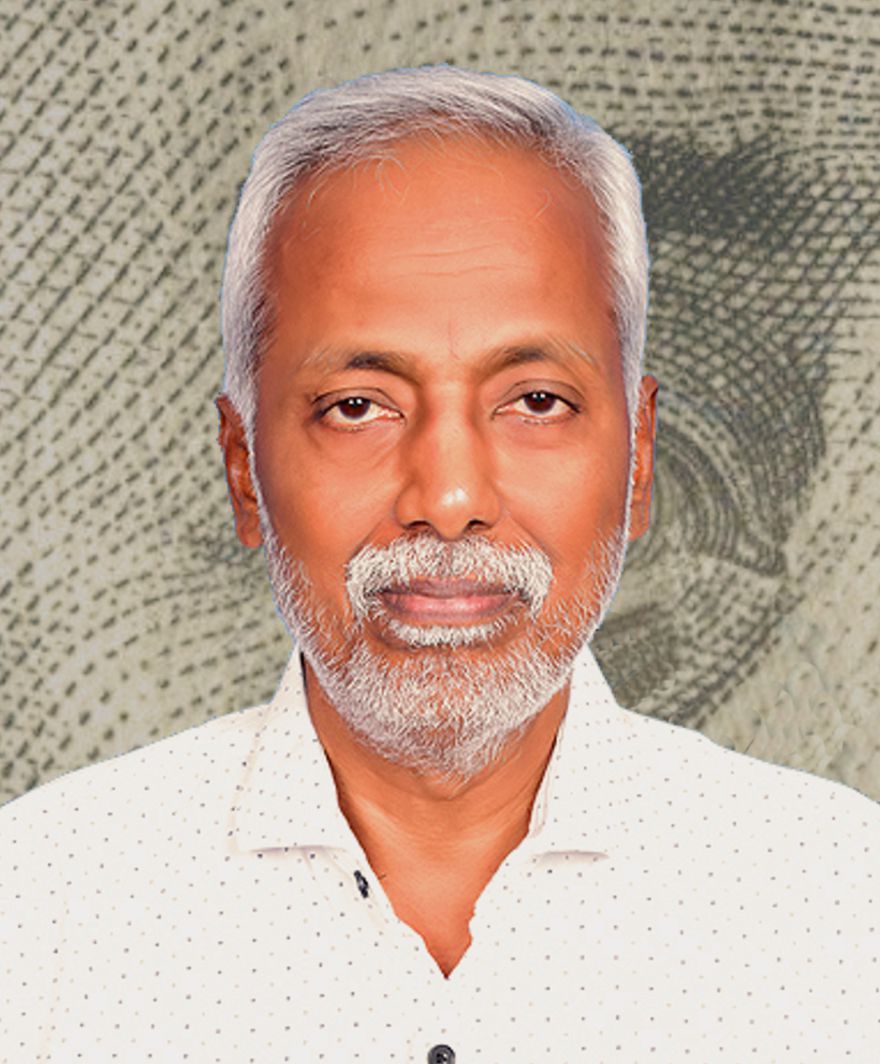

I am most indebted to Rajendra Rasu who had the vision and desire to compile this comprehensive presentation. His motivation is entirely altruistic- he is a true servant of humanity who wishes only to promote universal wellbeing.

It is Rajendra's sincere belief that his vision can be realized through a universal understanding of what I've presented over the last 30 years, recently popularized as 'Modern Monetary Theory' the recognition of which opens the door to public policy options previously not considered viable. This vision of a high quality standard of living includes universal full employment, healthcare, education, a constructive private sector, and all in the context of social equity.

After countless long hours of development, Raj's The Collected Works of Warren Mosler is now a reality. Rajendra, I salute you!

Warren Mosler

Selected Posts

Mosler: It's true for fixed fx (fx = Exchange) regimes that don't care about real terms of trade or the real standard of living.

Comment: Why do people (many economists included) assume that imports are a cost, rather than a benefit?

Mosler: They confuse monetary cost with real cost? And think the Federal deficit is a bad thing per se?

Mosler: The real wealth = domestic output plus imports minus exports. Not valuation vs some other currency that might be appreciating vs yours.

Comment: It is but shows no theory is a universal panacea for all nations. US resource rich & could probably get away without exporting or importing. NZ needs to export surplus to be able to import things of modern economy can't produce itself. NZ's problem is local food sold at export prices.

Mosler: Just saying optimizing real wealth is about sustaining full employment and optimizing real terms of trade.

Posts in chronological order

Comment: Right, even FICA tax cuts will eventually enrich the .1% as the money works its way thru from consumers to savers. Which is why.

Mosler: Don't forget to look first to what it does for real consumption and distribution of real consumption ;)

Comment: The economy is not a closed loop. Global capitalism has lifted millions of people from poverty around the world, and continues to do so by creating jobs in manufacturing. Profits from re-exporting these products funds new jobs.

Mosler: Jobs are the real costs. Its real consumption of real output that ultimately define poverty and the standard of living.

Comment: Systematic transfer of our nation’s prosperity to the 1%. Same for the UK @UKLabour needs to do economics.

Mosler: As far as standard of living goes, it's about the distribution of real consumption, and I have yet to see any discussion in that regard.

Comment: The ultra-rich have rigged our economy & rigged our tax rules. We need structural change. That’s why I’m proposing something brand-new: An annual wealth tax on the tippy-top 0.1%. We’d get $3 trillion in new revenue to invest in rebuilding the middle-class. Let’s make it happen.

Mosler: It doesn't reduce aggregate demand so it doesn't add any fiscal space... :(

Mosler: So it doesn't at all address the real issue- excess consumption by 'the rich' (or anyone else), and, in fact is a useful distraction for 'the rich' that works to delay resolution of this real issue. :(

Mosler: We can gain $trillions per year of fiscal space by eliminating most of the parasitic financial sector by deleting the supportive institutional structure that created it. Not mention how Medicare for all likewise cuts $1 trillion in real costs.

Selected Posts

Comment: Donald Trump says "China’s de facto tariff... has cost the U.S. billions of dollars and millions of jobs."

Mosler: Remind him exports= real costs, imports= real benefits, it's about real terms of trade, + jobs are about fiscal

Comment: Exactly right Warren. But the way trade deficits are being demagogued, I don’t hold out much hope of people grasping that. Maybe we should just say when you pay $25,000 for an imported car, you get a car in return.

Mosler: If Trump wins, consequently our domestic prices rise more than our real earnings, negatively altering our standard of living. AKA reduced real terms of trade etc.

Comment: "In the case of Turkey, a 10% depreciation of the Turkish Lira relative to its trading partners results in its import prices in Lira rising by 9.3% one quarter after the shock and by 10.0% eight quarters after the shock, a horizon referred to as the ‘long-run’." Gita Gopinath, IMF

Mosler: And how about export prices? At the macro level it's about real terms of trade. Internally, it's a (very serious) distributional issue. Real wealth is domestic output + imports, - exports (all in real terms).

Comment: This is characteristically sound in the classical Kaldor-Hicksian sense, especially over the short term. But the objection to vulgar Ricardianism isn't rooted in aggregative welfarism or global efficiency. It's rooted in distributive justice and national strategy.

Mosler: Distributive justice' is pretty much entirely a function of institutional structure including fiscal policy, which I suggest can be adjusted to desired 'distributive justice' without sacrificing real wealth via deliberate sub optimal real terms of trade.

Posts in chronological order

Comment: Using Fiscal Policy to Drive Trade Rebalancing Turns Out To Be Hard.

Mosler: Use fiscal policy to sustain full employment and a gov funded transition job- then optimize real terms of trade.

Comment: This is characteristically sound in the classical Kaldor-Hicksian sense, especially over the short term. But the objection to vulgar Ricardianism isn't rooted in aggregative welfarism or global efficiency. It's rooted in distributive justice and national strategy.

Mosler: Distributive justice' is pretty much entirely a function of institutional structure including fiscal policy, which I suggest can be adjusted to desired 'distributive justice' without sacrificing real wealth via deliberate sub optimal real terms of trade.

Mosler: Think real terms of trade. China has been the world's slave.

Comment: But a nation can't have ever increasing current account deficits without at some point getting into balance of payments difficulties. Floating FX doesn't change that.

Mosler: Please define 'balance of payments difficulties' with floating fx, thanks!

Comment: I would resist the urge to rush into signing free trade agreements with other nations. Relying on a combination of tariffs and subsidies instead to protect and nurture U.K. industry. We live in an age where the weaknesses of the Free Trade era are evident. It’s time for Security.

Mosler: Security comes from full employment levels of aggregate demand and a JG with decent compensation, etc. leaving you free to optimize real terms of trade, mindful of national security concerns, of course. ;)

Selected Posts

Comment: Venezuela, Russia and Ukraine (98), Ecuador (99), Jamaica (2010 & 2013) all defaulted on local currency debt.

Mosler: All fixed fx if I recall correctly? Happens all the time.

Comment: What Can Emerging Markets Do to Protect Against Hot Money? Not Much.

Mosler: how about no FX debt, full employment fiscal with a transition job, and a 0 rate and floating FX policy.

Comment: The solution? Abolish the Fed and let the market set interest rates & abandon the notion that one metric of inflation has any meaning.

Mosler: Markets set rates with fixed fx policy. With our floating fx policy, the govt does.

Comment: Is there ever a reason to raise interest rates?

Mosler: Not with floating fx policy.

Comment: Deficit monetizing, the last hope. Being sure of consequences maybe worth try/as a last social experiment

Mosler: Monetizing is applicable to fixed exchange rate regimes, not applicable to today's floating fx regimes.

Posts in chronological order

Comment: Is It Time for MMT To Become Mainstream to Save Us from the Second Global Financial Crisis of the Millennium?

Mosler: With floating fx, the natural 'risk free' nominal rate is 0.

Comment: IMF: Countries Should Take Action to Reduce External Imbalances.

Mosler: Floating fx expresses continuous balance between trade flows and non residents' net savings desires for that currency.

Comment: Is there such a thing as capital flight under a floating exchange rate policy?

Mosler: It's inapplicable as defined with fixed fx.

Comment: Scott Freeman on monetary surprises and nominal government debt

Mosler: The currency is a public monopoly. With floating exchange rate policy, the Fed is 'price setter' for interest rates, not 'price taker.' Inflation expectations per se don't alter interest rates. Only with fixed exchange rate policy, interest rates are 'market determined.'

Comment: "Without constraints on capital mobility, investors will continue to exercise a veto" over the ability of democratic governments to implement policies in the interests of their people.

Mosler: I don't see it that way. With floating exchange rate policy, I don't see investors having any such veto.

Selected Posts

Comment: Unemployment is correlated with high minimum wages, high long term govt unemployment benefits.

Mosler: If so, given that institutional structure, unemployment is the evidence the deficit is too small.

Mosler: That institutional structure is largely a highly counterproductive relic of the gold standard.

Comment: The only thing standing in the way of free Higher Ed is the profit-hungry Wall St bankers who fund both the Democratic & Republican parties.

Mosler: Because our Congressionally legislated institutional structure that establishes and supports said activities. Failure of Gov!

Comment: Small changes in the US like removing restrictions on direct Fed funding of Treasury and/or clarifying legality of Trillion dollar Coin will facilitate implementation of Job Gty - which is essentially trickle UP economics

Mosler: It can just as easily be done under current institutional structure.

Comment: It's not just a rampant expansion of our money supply; its money being created as it's spent on specific things... preferably jobs, technology, and infrastructure. But yes, under capitalism, it eventually concentrates in the hands of the owners.

Mosler: As largely determined by institutional structure.

Posts in chronological order

Comment: The only thing standing in the way of free Higher Ed is the profit-hungry Wall St bankers who fund both the Democratic & Republican parties.

Mosler: Because our Congressionally legislated institutional structure that establishes and supports said activities. Failure of Gov!

Comment: "You tax the rich because they are too damn rich and extreme concentrations of wealth especially, but also income, are bad for the functioning of the economy, are bad for democracy".

Mosler: How about eliminating the source of socially undesired income, since it's created entirely by institutional structure?

Comment: There is a reason MMT appeals to justice networks. "Can We Afford Economic Justice in the United States.

Mosler: Distribution today is entirely a function of institutional structure, and not some kind of 'natural order' etc.

Comment: If people think the invisible hand of the market is justly rewarding the hard work/talents of the 1%, it feels wrong to say the money has ended up in the wrong hands. But if you explain how the 1% uses their own hands to scoop up more than their fair share, it feels right.

Mosler: When the economy is not working to serve public purpose it's necessarily a failure of government and its institutional structure, and only remedied by same.

Mosler: No, there is no nominal limit to deficit spending under current institutional structure.

Selected Posts

Comment: Important point buried in this. Digital currency potentially increases likelihood of out-of-control bank runs.

Mosler: There's no operational constraint on available CB liquidity and no public purpose in not funding a fully capitalized bank.

Comment: If people think the invisible hand of the market is justly rewarding the hard work/talents of the 1%, it feels wrong to say the money has ended up in the wrong hands. But if you explain how the 1% uses their own hands to scoop up more than their fair share, it feels right.

Mosler: When the economy is not working to serve public purpose, it's necessarily a failure of government and its institutional structure, and only remedied by same.

Comment: Warren, @wbmosler, how important is the survival of private sector from this monumental shock, for the good of economy? Private sector is an integral part, isn't it?

Mosler: Yes. And in an institutional framework that directs it towards serving public purpose.

Comment: Tax only land not the capital part of real estate. They are 2 separate factors of production. Capital needs constant repair and renewal - land does not.

Mosler: I've proposed taxing real estate, including buildings, etc. (with exemptions when deemed to serve public purpose). I haven't read the literature that defines and uses the term 'land value tax' sorry!

Comment: OUR Gov as the monopolistic issuer of OUR currency, has a responsibility to insure that OUR currency is used only in ways that serve the public interest. Profit can be had but not if it hurts the public interest. Let’s see if my mentors agree.

Mosler: Yes, the way I say it is, that Gov (collective action) is there to support public infrastructure that promotes public purpose.

Posts in chronological order

Comment: Robert Hockett on the Accountable Capitalism Act introduced by U.S. Senator Elizabeth Warren.

Mosler: How about businesses be required to show how they will serve public purpose before given limited liability status?

Mosler: Banks are regulated agents of the state presumably created to serve public purpose.

Comment: Profits are the engine of capitalism. SOVEREIGN profits are the engine of socialism.

Mosler: Capitalism is about the state building the institutional structure/public infrastructure within which private markets operate for public purpose. Socialism is about the state owning the means of production.

Comment: How is inflation measured under MMT? In the early 1980s, the measurement of inflation included energy and food. Now it doesn't. The measurement of inflation has never included house price inflation. Should it? What else should be included or excluded?

Mosler: It's a political question. The definition is meant to serve to further public purpose. Not to forget the 'price level' is a function of prices paid by gov when it spends, so inflation is the continuous increases in price paid by gov, etc

Comment: I don’t support the job guarantee on the basis of how it might benefit the private sector. So I prefer placing the benefit on people at the forefront of my priorities.

Mosler: Agreed! Taxation causes unemployment, so Gov can then hire them to fully provision itself as mandated to serve public purpose. If unemployment remains after said Gov hiring, they need to transition back to the private sector, which doesn't like hiring unemployed. Enter the JG! :)

Selected Posts

Comment: Take another look at the decelerating German export and income growth.

Mosler: Exports are the real cost of imports. Sustain full employment, let trade adjust.

Comment: How does currency depreciation not affect ability to import?? Does that apply to all countries, or is this only applicable to reserve currencies?

Mosler: Real exports exchange for real imports, directly or indirectly, at 'world prices' even if you don't have a currency at all.

Comment: Because demand expansions will push out the current account deficit further.

Mosler: And that's a good thing= lower taxes or more public services. At the extreme, if you export everything and don't import, you have nothing and die. You are arguing to kill the goose laying the golden eggs.

Comment: But we’re talking about a situation where CADs and BoP are causing problems for a country. So it goes too far to suggest that imports are always a benefit that exports are a cost and that external issues are never of concern.

Mosler: CAD's and BOP's per se may be political problems of concern, but not real economic problems. Same with imports being real benefits and exports being real costs.

Comment: My only beef with MMT. Not always case surely. Eg Saudis have a surplus of oil they cannot possibly use themselves. Ditto NZ and milk or lamb meat. Economy based on exporting surplus.

Mosler: And the point of exporting that stuff is to buy imports, no???

Posts in chronological order

Comment: "Rising import competition from China reduced US employment growth by between 2.0 & 2.4 mln jobs between 1999 & 2011"

Mosler: A good thing! But wrong policy response! Taxes can be lower and/or spending higher to sustain full employment!

Comment: It's time to dethrone the dollar & bring back the jobs.

Mosler: Imports real benefits, exports real costs-so cut taxes and/or hike spending to boost jobs instead of dethroning $US!

Comment: Warren, pundits speculating US losing its reserve status. In the event of a SDR type replacement, what happens to the public money monopoly?

Mosler: The currency monopoly remains. Worst case- real terms of trade diminish/real net exports increase.

Comment: Yes! More on the different sources of inflation please !!!!

Mosler: Insiders getting local currency via the banking system and state owned enterprises and selling it for foreign currency for personal use, driving down the currency causing import prices to rise, for example

Comment: This man is not well. He just isn't. Lives hang in the balance and it's just rotting cottage cheese up there.

Mosler: Point of fact, the US trade deficit is about US exploitation of China and the other net exporters, whether any of them know it or not. And Trump tariff policy, etc., is meant to kill the goose that's been laying our golden eggs. ;)

Selected Posts

Mosler: Gov. 0 rate policy euthanizes rentiers. AND creates fiscal space for more public spending and/or lower taxes!

Mosler: Corporations that move jobs to Mexico create fiscal space for your infrastructure proposals!

Comment: This is the US/Canada trade data for 2017, according to the US government. It shows the US with a modest $2.76b surplus. We have a very large dairy surplus with Canada as well, suggesting, by the president's own criteria, we are unfair to them. But I don't think that's the case.

Mosler: Not to forget, imports are real benefits and exports real costs, it's better to pay less than more, and a trade deficit gives that nation more fiscal space. ;)

Comment: China offers 6-year import boost in trade talks with US.

Mosler: This would "use up" our fiscal space.

Comment: Trump takes dig at Japan for 'substantial' trade advantage and calls for more investment in US.

Mosler: Seems the President still doesn't know, this is producing the fiscal space for his tax cuts.

Comment: Venezuela to add Bitcoin and Ethereum in central bank's reserves - AMBCrypto.

Mosler: Expenses like this add to their inflation problem. Buying said assets with local currency uses up 'fiscal space'.

Posts in chronological order

Comment: Agreed the so called "bleeding hearts" suddenly care more about "prices" rather then people having a productive job to shelter, feed, cloth, and educate their family with dignity. Hard to pay less for something if you don’t have a job!

Mosler: Trade deficit= a productivity increase= fiscal space to lower taxes or increase public services to sustain full employment levels of aggregate demand. Imports are real benefits, exports are real costs- the problem is the policy response that turns a good thing into a bad thing

Comment: "Our economy is really doing well" - President of the United States!

Mosler: Not to forget that productivity increases create fiscal space for the GND

Comment: The corona virus test should be made widely available and free. The corona virus vaccine, when ready, should be made widely available and free. Treatment for corona virus should be free, too. We're in a crisis. No one should have to pay for their corona virus health care costs

Mosler: I agree there should be no charge, but it's not free in real terms and it does use up fiscal space....

Comment: States collect taxes and are sovereign in the same way as the federal govt. States could issue "vouchers" to pay health workers, for example, which voucher recipients could use to pay state taxes. This is consistent with MMT.

Mosler: Yes, states can and do use tax credits/(vouchers) to deficit spend, and so doing transfers 'fiscal space' from the Federal to the state Governments.

Comment: And why do I have to keep on reminding you that Bill Gates wasn't rich when he built Microsoft? He got filthy rich afterwards, by extracting money. And he's still sitting on it. Big piles of saved money don't get recycled back into the economy.

Mosler: Sitting on it, leaves that much fiscal space for increased public services or tax cuts. (That choice is political.)

Selected Posts

Comment: Because no one collects, 70% is ours, nice little system for unlimited capacity.

Mosler: Currency issuers must spend first, then collect/borrow back own money

Mosler: Start with the fact that the currency is a public monopoly/unemployment is evidence of restricted supply.

Comment: Global Debt Has Risen by $57 Trillion Since the Financial Crisis, Which Is Scary.

Mosler: Local currency debt is just the money spent by Gov that remains outstanding until used to pay taxes.

Mosler: Deficit limits are limits on total net savings of that currency.

Comment: Yes. I (normally) think of currency as a (de facto/de jure) government monopoly.

Mosler: And monops 'set' 2 prices: Own rate (interest rate for currency) and terms exchange for other goods + services.

Mosler: I've shown how their high policy rate is supporting their inflation rate and depreciating the currency continuously over time. They need to drop it to 0 imho.

Posts in chronological order

Mosler: Right, the national debt is just the 'monetary base' of the economy for any nation with its own fiat currency.

Comment: Why no inflation? The question every banker wants an answer to

Mosler: The price level is ultimately and necessarily a function of prices paid by the gov when it spends- simple case of monopoly.

Comment: Think perfectly flexible prices & wages, full-employment, very classical etc. Stuff you would hate ;-)

Mosler: Understood, and 'money' is only a numeraire. Ever try modeling a currency as a public monopoly? ;)

Comment: There is massive amount of empirical and theoretical evidence that markets don't self correct. Fisher provide the case when private debt is large, Cambridge controversy show that relative prices mechanisms are not reliable mechanisms of stabilization.

Mosler: That's because the currency itself is a case of a (coercive) monopoly.

Comment: Personally, biggest ones for me would be the idea that fully abolishing CB independence won't have seriously negative effects (when we have great reasons to worry about that), or that permanent ZIRP won't have negative effects.

Mosler: Understood. First, I argue that the base case for a floating fx currency is ZIRP, and operationally it takes continuous state intervention to support rates at higher levels- treasury securities, interest on reserves, etc.

Selected Posts

Mosler: Since today's currencies are Government monopolies, Gov. is necessarily price setter, so they are all necessarily 'manipulated' via Gov. policies .

Comment: That assumption is in my models. Not sure what you think falls in place though. It's just standard monetary theory.

Mosler: Monops set 2 prices 1. own rate= policy interest rate set by Fed as single supplier of net reserves 2. terms of exchange for other goods and services= price level is necessarily a function of prices paid by Gov. spends=source of price level.

Mosler: Also empirical, but it means, for openers, that inflation expectations aren't the cause of inflation, and that it's Gov spending policy+institutional structure that turns relative value stories into inflation stories (not that it isn't necessarily 'good policy' to do just that).

Mosler: Assuming a market economy, it follows the Gov need only set one price and let market forces work such that prices reflect relative value. That's what fixed fx policy is about. With today's floating fx policy, the de facto 'price anchor' is unemployment (rather than gold), etc.

Comment: Tying policy to labor force participation would give a more accurate assessment of inflation risks and distance to full employment than just focusing on the unemployment rate.

Mosler: Recognizing the currency is a public monopoly and therefore the state is 'price setter' would also be helpful, as would recognizing rate hikes impart an inflationary bias through interest income and forward pricing channels.

Comment: First of all, thank you very much for your reply. Without an increase in the interest rate and with a lot of Argentinian pesos circulating, what measures would you think should be taken to lower inflation?

Mosler: Start by cutting the local currency policy rate to 0. Then examine the source of the price increases, including loans to SOE's and 'insiders' that 'count' as deficit spending and result in the selling of those funds for fx.

Posts in chronological order

Mosler: Monopolists are price setters, whether they know it or not!.

Comment: MMT - School of thought or set of personalities? Semantics or substance?

Mosler: Left out the fact that the currency is a simple public monopoly so the state is necessarily 'price setter'.

Mosler: The state sets the policy rate at 0 and offers a state funded transition job to all takers to both facilitate the transition from unemployment to private sector employment and enhance price stability, and adjusts fiscal balance to minimize the # of transition workers.

Comment: Is this saying that it was the 'hyper-enlarged' deficits that contributed to the hyperinflation? It also mentions failing to balance budget [revenue... failed to keep in step with its spending].I don't think this is in line with the rest of the document? Maybe further clarify.

Mosler: The point is that the higher prices paid are the redefining/devaluation of the currency. And the paying of the higher prices contributed to gov facing further price increases that gov again decided to pay. It's the paying of the higher price that redefines/devalues the currency.

Mosler: Seems shifting tax liabilities from income and sales tax to property taxes would dramatically reduce price pressures from non residents and investors and it could be drafted so residents pay about the same as they do now. Plus lower compliance costs= higher real wealth.

Selected Posts

Comment: Taxing always has to be looked at as the final step in the process. Never view it as taxing as the precursor to spending. Interest payments to wealthy and big corporations are a political choice, not a functional necessity. It is not efficient monetary policy.

Mosler: However, tax liabilities do come first, which creates sellers of goods and services that can then be purchased by the state. Actual tax payments follow state spending or lending.

Comment: The U.K. government first mobilises real resources by data entry into its spreadsheet, adding numbers denominated in its unit of account, the £. Taxes reverse the process, deleting numbers and driving demand for its currency. Smart folk have known this for decades.

Mosler: I like to begin the story a bit before that, where the UK gov. first imposes a tax liability, payable in £ that come only from the gov or its agents, which creates sellers of real goods and services needing the gov's spending of £ to pay their taxes.

Comment: An MMT critique from the man who bailed out the banks. Others have already shares strong words about this. Some comments from me: https://t.co/1bB3vsZ04N?amp=1

Mosler: MMT teaches sequence- tax liabilities, spending, tax payment/bond purchase- thereby eliminating solvency consideration, and the source of the price level is prices paid by Government. And they have the rate thing backwards. No new tools, just a new (for them) understanding of the tools.

Comment: There are three sentences here. The first is, at the very least, neutral with respect to MMT. I presume Stephanie Kelton would say that affordability is never an issue. She can correct me if I’m wrong on that. The second appears to be ... 1/n

Mosler: Think sequence- spending from single supplier of that which is required for tax payment adds the $ that subsequently pay taxes/buy treasury securities, so (nominal) 'affordability' and 'debt burden' inapplicable.

Posts in chronological order

Comment: Taxes are, in fact, “demand drains” and so reduce the capacity of the non-government sector to spend. Taxpayers do not fund anything. They just lose or gain purchasing power as the national government manipulates the policy parameters

Mosler: Tax liabilities precede spending.

Selected Posts

Comment: The "inventor" of modern money (MMT) @wbmosler: Federal gov does not need to tax anybody, sovereign countries issue own money.

Mosler: Tax liabilities are required to create sellers of goods and services desiring that currency in exchange thanks.

Comment: What prices are government agents setting, exactly?

Mosler: With every purchase govt. defines the value of its currency whether it knows it or not. The econ needs govt spending to comply with coercive tax liabilities. It's about who's pitching and who's catching. It's a simple case of monopoly. Elementary game theory / disparity of power.

Mosler: The MMT insight - which is literally what created it as a body of theory - is that a JG can be used as a buffer stock approach to stabilise wages. Saying the JG is not part of the theory just says that you don’t understand the theory.

Mosler: The MMT insight (and a contribution to the economic history of thought) is that tax liabilities are the cause of unemployment as defined=unemployment is a monetary phenomena caused by gov by design to hire the unemployed to provision the gov with its otherwise worthless currency.

Comment: Pitch your best short idea and in one tweet (no threads) explain exactly why you hate money.

Mosler: Monetary tax liabilities- the continuous requisite coercion that supports highly beneficial and desired collective action- instils a permanent, pervasive, fundamental insecurity of running out of tax credits (money) that brings out the worst in people.

Posts in chronological order

Mosler: The tax liability is the arm of today's 'invisible hand' ;)

Comment: That’s not what MMT says. Tax has many purposes. As @RichardJMurphy would say. But financing spending is not one of them. Thus, Speaking of the need to tax to finance the NHS is hugely damaging. #MMT takes a lot from Keynes. More so than most orthodox economists today

Mosler: I say it this way: tax liabilities, and not tax revenues per se, function to create sellers of goods and services in exchange for the state's currency, which the state can then buy.

Mosler: That is, there is a distinction between tax liabilities and tax revenues.

Comment: Former ICE Gov Dir. Tom Homan shows no respect to Rep Jayapal during a House hearing today after going over his time, shouting out, “I'm a taxpayer, you work for me!”

Mosler: More nearly correct would have been 'I have tax liabilities, I'm working for you.'

Comment: Issue 1: Debt is a stock (a total you have at one time) and GDP is a flow (the total over a period of time). Better to compare stocks to stocks (or flows to flows). Not hard to pay off $20T of debt when US GDP totals about $4 quadrillion going forward.

Mosler: That debt already is the money- $ in cash+ reserves+ securities accounts, all Fed liabilities (functionally) = net financial assets of the economy= equity that supports the entire private credit structure=net money supply.

Comment: Perhaps you, or @AlanKohler could elaborate as to what happens when people lose trust in the underlying value of the infinite fiat that is issued for them to store/exchange, um, value?

Mosler: If it was about trust it would have collapsed a long time ago. It's a tax credit needed to satisfy coercive tax liabilities.

Selected Posts

Comment: The federal government does not need taxes in order to spend. Those who claim otherwise must provide their explanation.

Mosler: It's about needing to impose tax liabilities, rather than needing to get the $ to spend....

Comment: Paul, you hedge with language taking about things like, “people are still willing to lend to the US,” I haven’t heard you say in uncertain terms that the only restriction on US federal spending is potential inflation. Full stop.

Mosler: In fact, from inception, with $ to pay taxes coming only from the gov or its agents, gov necessarily spends first, and then taxes can be paid and bonds purchased. In Fed speak, you can't do a reserve drain without a prior reserve add. So 'willing to lend' is inapplicable.

Mosler: Keynes' own words here are good too ... not sure whether @tragicbios included that in his write-up:"The contention that the unemployment, which characterises a depression is due to a refusal by labour to accept a reduction in money-wages [nominal income] is not clearly supported by the facts. It is not very plausible to assert that unemployment in the United States in 1932 was due either to labor obstinately refusing to accept a reduction in money wages or to obstinately demanding a real wage beyond what the productivity of the economy was capable of furnishing.".

Mosler: Unemployment is necessarily the consequence of the gov- the currency monopolist- not spending enough to cover the tax liabilities it imposed + 'savings desires'.

Comment: We obviously have enormous GDP losses now that cannot be fixed by deficits, & tremendous need for taxes & transfers to support GDP in future. But after squandering it for years, we may have little fiscal capacity. So we have to be very efficient w/ tax & transfer programs.

Mosler: With floating fx 'fiscal capacity' is inapplicable. Gov spending is via the crediting of member bank reserve accounts, a process not constrained by revenues.

Posts in chronological order

Mosler: Spending more than income offsets spending less than income.

Comment: No one has produced a careful analysis to work out how much of the net, new spending might need to be offset: Democratic presidential hopefuls are floundering a bit over Medicare for All. Let's hope they get clear about it, in particular the reality that completely going to single-payer would require a LOT of revenue.

Mosler: Too much net spending = only a one time increase in prices that can readily be reversed, without a drop in employment or output. It does not 'trigger hyperinflation' or anything of the sort. But too little = unemployment and lost output. So what are we waiting for??? ;)

Comment: Disney CEO explains how profits from merger w/ Fox will come from massive layoffs. As usual, layoffs' costs to workers, their families, & communities does not matter to capitalist. Private profits are far less than social costs but the profiteers decide.

Mosler: Jobs are real economic costs of production, not benefits. The crime against humanity is the state not supporting aggregate demand (total spending) at levels high enough to ensure business profits from providing well paid employment to displaced workers, etc.

Comment: How is inflation measured under MMT? In the early 1980s, the measurement of inflation included energy and food. Now it doesn't. The measurement of inflation has never included house price inflation. Should it? What else should be included or excluded?

Mosler: It's a political question. The definition is meant to serve to further public purpose. Not to forget the 'price level' is a function of prices paid by gov when it spends, so inflation is the continuous increases in price paid by gov, etc.

Selected Posts

Mosler: Gov debts are the economy's base money spent by gov and not yet used to pay taxes. Nothing to "pay off".

Comment: Correct. But IMHO private banks have no power to cancel/extinguish tax credits. Only CB can do that.

Mosler: Reserves are $ balances/tax credits in accts at the CB, only the CB makes debits/credits to its own books.

Comment: Or if you artificially control the labor markets, you get unintended consequences like corporations owning your health insurance rather than free markets determining price and quality. BTW real wages are currently increasing albeit maybe at a pace that you don't like.

Mosler: Coercive taxation obviates any notion of 'neutrality of money', etc. and markets function within state established institutional structure, in which game theory has application.

Mosler: Likewise to the first candidate to recognize that a permanent 0 rate policy eliminates gov interest payments, downsizes the financial sector, and is a deflationary bias, all of which 'replaces' the need for tax hikes as it all 'makes room' for the progressive agenda.

Comment: Of course, many years ago Summers was a proponent of financial transactions taxes. he was very much on the mark on that one. Great tax -- raises revenue by reducing waste in the financial sector.

Mosler: For me the public purpose of a transactions tax is to reduce transactions, not to raise revenue per se. Success is measured by how little revenue is raised. Also, institutions are pass throughs, so to the extent pension funds, IRA's etc. pay the tax, it can be highly regressive.

Posts in chronological order

Mosler: Yes, tax credits spent that remain outstanding as cash, reserves or securities balances until when and if used to pay taxes.

Mosler: Think of the national debt as tax credits awarded not yet used to pay taxes, resting as cash, reserves, and securities accounts at the Fed.

Comment: Looking forward to my interview with President Obama tomorrow on all things economic.

Mosler: How can Gov be "out of money" when operationally it has to spend first, then collect tax or borrower its own money back?

Comment: If true, that would mean that paying off the public debt would be very unlikely to cause inflation, no?

Mosler: Public debt is the accounting record of non gov net monetary savings. Why would you want to tax away that savings?

Comment: How do we fund the refugee crisis? With a Tobin tax?

Mosler: The CB's just credit the appropriate accounts- no tax needed while unemployment remains elevated ;)

Comment: What's the argument for thinking of fiscal stimulus in terms of private balance sheets rather than income flows?

Mosler: Unemployment evidences fiscal restriction that can be immediately removed with a tax cut or spending increase.

Selected Posts

Mosler: Public debt=cash+reserves+tsy secs=total $ spent by gov that haven't yet been used to pay taxes=total outstanding "tax credits"=net "money supply".

Comment: And doesn't matter if the Fed buys the bills or not.

Mosler: The T bills are 90 day $ deposits in client securities accounts at the Fed. If the Fed buys them, they pay for them by crediting $ reserve accounts at the Fed for the same clients, and debits their securities accounts. Either way clients have their $ in Fed accounts.

Comment: Do you think that we should have federal bonds Mr. Mosler?

Mosler: No, but for all practical purposes limiting issuance 3 mo bills does the trick and doesn't require changing the institutional structure.

Comment: Got to think in real terms not nominal terms. In real terms fiat currency always looses value. So debt is paid by inflation itself not necessary to repay it in real terms. And at the same time, increase taxes so get the best of both sides. It's the only way to support deficits.

Mosler: The public debt does the 'supporting' as it's the net financial assets supporting the entire private sector credit structure.

Mosler: Please rethink the 'repay the outstanding debt' presumption, when it's nothing more than the $ (tax credits) spent by gov that haven't yet been used to pay taxes=tsy secs=$ balances in securities accounts at the Fed=net financial assets in the economy= the 'net money supply'.

Mosler: That is, the public debt already is 'the money', and what's called 'paying it back' is the Fed, when Treasury securities mature, debiting securities accounts and crediting reserve accounts for the same amount of $. No tax payers or grandchildren are involved....

Posts in chronological order

Comment: I just published “Macroeconomics — a view from the peanut gallery” https://t.co/qoNfy3tA5z?amp=1

Mosler: Gov debt is 'repaid' via the CB crediting a reserve account and debiting a securities account, all on its own spreadsheet

Comment: As recession looms, could MMT be the unorthodox solution? The MMT theory debate is welcome in a world laying bare the constraints of conventional policy

Mosler: Yes, except what they call 'money financing' is functionally identical to what I've proposed for a very long time- a zero rate policy and limiting the Treasury to issuing nothing longer than 3 month t bills- which doesn't require changing anything else.

Mosler: Don't even bother reading this type of stuff about funding the Federal deficit. Treasury securities are just what the Fed calls a 'reserve drain' of no economic consequence.

Comment: That is, they inflated away the purchasing power vs CPI of anyone actually holding Treasuries or bank savings deposits, as yields were forcibly kept below the prevailing inflation rate. People/institutions with substantial USD savings were hurt; those with hard assets preserved.

Mosler: Either way with floating fx the public debt is just $ (tax credits) in securities accts at the Fed-it already is 'the money'-so it's never about gov 'paying it back' as it is with fixed fx. Gov/real domestic wealth doesn't gain or lose from changes in the price level.

Comment: That's Debatable: Stop Worrying About National Deficits .

Mosler: More simply when it's realized gov necessarily spends first and only then can taxes be paid or gov bonds purchased, and that rate hikes cause inflation, notions of gov solvency, debt burdens, etc, become entirely inapplicable.MMT White Paper - The Center of the Universe

Selected Posts

Comment: In 2010, Derryl Hermanutz asked:"Why do countries have to borrow their own currency from private banks who merely create it out of thin air?"We don't have the answer yet but at least more people are talking about it.

Mosler: They borrow to support rates that would otherwise go to 0 (not to fund themselves) and the banks are, functionally, agents of Congress via the Fed Reserve Act, all in my book.

Comment: Advocates of #MMT-style fiscal stimulus point to Japan as one example why the US can sustain far higher debt levels. There's a big difference. Only 13% of Japanese debt is held by foreigners. That number is 40% for the US. We are much more exposed to what foreigners think and do.

Mosler: It's just a reserve drain, get over it... ;)

Comment: In order to create counterparty-style debt, banks typically need to have “reserves” they hold on their books, and can only lend a multiple of reserves. This is how we control debt levels.(yes, I know there are no reserve requirements right now - sit down I’ll get to you).

Mosler: With today's floating exchange rate policy, lending is not reserve constrained. The deposit is created as payment for your signed note, and if a reserve requirement incurred, in the first instance it's functionally an overdraft in the bank's account at the Fed.

Comment: The Treasury market is now so big that the Fed may have to keep buying the debt to keep it functioning properly: Fed's Quarles. "The sheer volume there may have outpaced the ability of the private market infrastructure to support stress of any sort there.”

Mosler: Wrong, it's just a reserve drain/offsetting operating factors and all that. Get over it!

Posts in chronological order

Comment: Banks do not lend because they have reserves. They get reserves because they have lent! Loans create deposits and then reserves are added.

Mosler: More precisely, loans create both deposits and required reserves, all as a matter of accounting.

Comment: Having trouble following this thread but seems to have started as some semantic thing about money vs net financial assets. My view is taxes destroy "money", surpluses destroy "net financial assets". Now have to get back to family TV viewing :)

Mosler: Tax payments are debits (reductions) to a member bank's reserve account at the fed, and ultimately) credits to the tsy's account at the fed. Tsy is part of govt, so its balance is accounting information of no consequence to the economy.

Comment: I think swaps characterize the event well. But yeah, drill down to the characteristics of the instruments being swapped: 1. Fixed-price (hence Fed-set aggr stock), Fed-set rate, zero-maturity for:2. Variable-priced (so variable stock), market-set rates (?), dated maturities.

Mosler: Both reserves and tsy secs are deposits at the Fed defined as "money" under broader definitions of money, and the same goes for checking and savings accounts at other bank's.

Comment: We obviously have enormous GDP losses now that cannot be fixed by deficits, & tremendous need for taxes & transfers to support GDP in future. But after squandering it for years, we may have little fiscal capacity. So we have to be very efficient w/ tax & transfer programs.

Mosler: With floating fx, 'fiscal capacity' is inapplicable. Gov spending is via the crediting of member bank reserve accounts, a process not constrained by revenues.

Selected Posts

Comment: Rolling over the debt+interest forever may or may not be sustainable. That's where the r</>g condition kicks in.

Mosler: Interest is paid via the Fed crediting an account on its own books.

Comment: Personally, biggest ones for me would be the idea that fully abolishing CB independence won't have seriously negative effects (when we have great reasons to worry about that), or that perma ZIRP won't have negative effects.

Mosler: Understood. First, I argue that the base case for a floating fx currency is ZIRP, and operationally it takes continuous state intervention to support rates at higher levels- treasury securities, interest on reserves, etc.

Comment: Temp check - who wants #M4A & the #GND even if we fail to force billionaires & their armies of attorneys to surrender more $ to the federal government? I want to do both things badly, but I'm down to start building a new world with or without the "contributions" of the wealthy.

Mosler: And see my proposals to eliminate said incomes at source: 0 rate policy, insured pensions can't buy equity, narrow banking, attach public purpose strings to limited liability status, etc.

Comment: I would prefer to say the effects of an interest rate change are many and contradictory. The interest paid by gov pushes on the gas, the rate charged borrowers pushes on the brake. The increased cost of production can push up prices, while change in demand could affect bargaining.

Mosler: For every (non gov) borrower paying interest there is a lender receiving interest and it all nets to 0. That leaves govt as a net payer of interest to the economy. What's left to analyze are the differing propensities to spend regarding interest income and interest expense.

Comment: The world’s central bankers have a confession to make: They’re not sure whether the tools they’ve been using for decades work anymore.

Mosler: Yes, if anything, monetary policy tools work in the reverse direction when the state is a large net payer of interest. Not to mention the forward pricing channel... ;)

Posts in chronological order

Mosler: Govt. 'money finance vs debt finance' is a fixed exchange rate distinction inconsequential to floating exchange rate regimes.

Comment: What Can Emerging Markets Do to Protect Against Hot Money? Not Much.

Mosler: How about no FX debt, full employment fiscal with a transition job, and a 0 rate and floating FX policy.

Comment: My latest piece is up at https://t.co/XWfqPDBS3c?amp=1

Mosler: With floating exchange rate policy, interest rates can be set anywhere the state wants.

Comment: The Fed is not going to solve wealth and income inequality. They might help on a margin by heating the labor market, but the Fed is not your solution.

Mosler: Fed rate cuts to 0 have dramatically reduced interest payments that I call basic income for those with money and gov securities trading fees/income are down. And deflationary 0 rates allow higher fiscal deficits=more income for lower income earners=(unintentionally) good job Fed!

Comment: Interesting exchange. Ann making a point MMter’s constantly make. The state sets the interest rate. So “we can borrow now because interest rates are low” still conforms to the household analogy, because it compares the state to a household who has to accept rates from the market.

Mosler: A permanent 0 rate policy is a deflationary bias that promotes low inflation and low demand, thereby requiring larger fiscal deficits to support full employment. And that's just one reason why I propose it.

Selected Posts

Mosler: 0 is the 'natural rate' of interest, inflation, and unemployment. Deviations are necessarily a consequence of government policy.

Mosler: Thought exercise- if all prices go up and the gov doesn't pay those higher prices, gov spending goes to 0 and the price level deflates until gov spending is sufficient for tax payments due. Not that it's 'good policy' to do that, but to reveal the source of the price level!

Comment: To clarify - I think we all agree JG politics are inseparable from the financing framework. We all want to avoid the problems Kalecki highlighted. If we make the JG dependent on taxes, aren't we...giving the rich back-door capital strike leverage over the transitional demand?

Mosler: From a pure monetary perspective, the purpose of JG is to provide a superior anti inflation price anchor when compared to unemployment, by facilitating the transition from unemployment to private sector employment. Who is against that???

Comment: The impact of a JG in increasing efficiency/productivity and therefore push down interest rates?

Mosler: Just means funding a JG doesn't take away the ability to fight inflation with higher rates as critics fear, because in any case higher rates cause inflation, rather than fight it.

Comment: The definitions of 'inflation' are 'for further purpose'. For example, the consumer price index is about the cost of living of a representative group for the further purpose of public policy, etc.

Mosler: Also the academic def of inflation is a continuous increase in the price level faced by today's agents. That is, forward prices, which are a direct function of the term structure of rates set by the CB. That is, academically the inflation rate *is* that interest rate structure.

Posts in chronological order

Comment: How is it not a logical fallacy to think the Fed needs to keep a positive slope in the yield curve to avoid a recession when that would basically imply they will always be raising interest rates?

Mosler: Higher rates support demand and inflation through interest income channels and forward pricing channels. That is, a positive policy rate provides basic income for those with money.

Comment: We show why job guarantees are better than universal basic income

Mosler: And the JG provides for a superior price anchor than today's unemployment policies. That is, the JG is an anti inflation policy that at the same time supports output.

Comment: How is inflation measured under MMT? In the early 1980s, the measurement of inflation included energy and food. Now it doesn't. The measurement of inflation has never included house price inflation. Should it? What else should be included or excluded?

Mosler: It's a political question. The definition is meant to serve to further public purpose. Not to forget the 'price level' is a function of prices paid by gov when it spends, so inflation is the continuous increases in price paid by gov, etc.

Comment: Sure! Basically, same functionality (gov spending creates its own funding, like in the US) but constraints are different: too much money creation (via fiscal deficits or net bank lending) pushes imports up => current account deficit => pressure on the exchange rate => inflation.

Mosler: Gov spending per se doesn't alter 'the price level.' It's the gov paying higher prices 'for the same things' that redefines the currency downward. That is, the price level is a function of prices paid by the currency monopolists. Monopolists are price setters, etc. (micro 101 ;)

Selected Posts

Comment: QE helped the economy tremendously. We were headed for a second Great Depression without it. Krugman was right about that. Now, the transmission mechanism they chose/were forced into for the stimulus worsened inequality, but it also stabilized the economy.

Mosler: QE is just a placebo, not to say placebos can't possibly make a difference.

Mosler: Proving yet again and beyond a shadow of a doubt that QE and low rates don't "stimulate" and are not inflationary... ;)

Comment: What happens to the money that banks pay to buy bonds from the treasury? Does that money go somewhere or does it disappear from the system the same way you claim that collected taxes disappear? Any article or blog that explains this?

Mosler: Operationally the Fed does the 'spending first' part. With QE, the Fed bought and paid for tsy secs, and those funds are then 'used' to buy new tsy secs

Comment: Do you agree this statement, if IOER were 100 basis point below FFR would lead to decrease in reserves?

Mosler: Fundamentally, the Fed has 2 choices- 1) Keep the system (functionally) net borrowed and set rates via the resulting reserve add, as was the case before QE or 2) Keep the system (functionally) net long and set rates via paying interest on reserves which it's been doing post QE.

Comment: Exactly how it exists today, but QE destroyed the savings mkt while Treasury sought to shrink the spreads. where is the incentive on “saving” w/a 30yr instrument right now at locked in at 0.1%. The rate spread policy has to change meaningfully.

Mosler: Japan has had 0 rates and endless QE going on 30 years, and ultra high savings with no end in sight as well. So maybe lower rates = more savings? For one thing, pension contributions tend to get hiked when rates go down, etc?

Posts in chronological order

Mosler: Fed knows QE doesn't work http://moslereconomics.com/2013/10/04/fed

Comment: "The Fed has sent Treasury $421 billion over the last 5 years."

Mosler: Thereby reducing aggregate demand and slowing the economy. That is, as previously discussed, QE functions largely as a tax.

Comment: Quantitative easing has never been repaid. And there’s not a hope it will be.

Mosler: Properly understood, reversing QE would be done to support higher longer term rates. And today's growth is in spite of QE.

Comment: Key point. Any EM policy maker will be very critical of #MMT, because they know that the ultimate constraint on a country and it's ability to ease fiscal & monetary policies is the currency. Across EM, currencies have been in free-fall, sharply curtailing the ability to do QE etc.

Mosler: In any case with floating fx policy, QE per se is just a placebo. It only increases M under narrow definitions that don't include tsy secs. Fixed fx is an entirely different matter.

Comment: As the @federalreserve puts a wrap on its Framework Review, key decisions remain to be made. One big one: how best to harness the power of its balance sheet to fight recessions. Permanently low interest rates put central banks in a tough spot; they need new tools.

Mosler: Remembering our meeting 10 years or so ago. I wasn't concerned about the then concerns of QE having an inflationary effect as I was about QE at the time removing some $90 billion of interest income from the economy and thereby imparting a deflationary bias.

Selected Posts

Comment: Does that imply that without taxation (assuming money continued to work) that there would be full employment?... Because that seems unlikely.

Mosler: Yes there is no unemployment as we define it in non monetary societies.

Comment: To argue that the JG would be the "single largest government intervention in US economic history" betrays the author's poor understanding of history.

Mosler: Taxation is the intervention that creates unemployment by design for the further purpose of the state being able to hire those it's tax caused to be unemployed. The JG works to transition the unemployed back to private sector employment and optimize output.

Comment: We have a system which does not have enough money to repay credit issued with interest. The system can only operate with defaults and asset transfers. Is this the best we can do?

Mosler: If all income (including interest income) is spent, there is no problem. Unemployment is an unspent income story.

Comment: That assumption is in my models. Not sure what you think falls in place though. It's just standard monetary theory

Mosler: Monopoly restricting supply=excess capacity, so currency monopoly restricting supply of funds needed to pay tax/desired as net savings is evidenced by unemployment. Multiple equilibriums come from multiple fiscal stances by currency monopoly? Also monopoly obviates market clearing. Micro 101?

Mosler: Ex post, unspent income = public + private deficit spending. So when private deficit spending slows (=savings rate increase), total spending falls short (unemployment increases) unless public deficit spending increases and fills the gap= unemployment is an unspent income story

Posts in chronological order

Comment: Growth & jobs and why we’re where we are: http://bit.ly/17ijJja

Mosler: Unemployment is the evidence the deficit is too small, by identity.

Mosler: Start with the fact that the currency is a public monopoly/ unemployment is evidence of restricted supply.

Comment: “We Need Universal Income Because Robots Will Steal All the Jobs".

Mosler: But wrong again. Unemployment is always an unspent income story and never a productivity story. And not related to basic income.

Comment: What Taxes are For?

Mosler: The purpose of taxes is to create unemployment (as defined) so govt. can hire those it unemployed to provision itself.

Comment: Yeah I see the point and agree. But if unemployment results only because currency is saved rather than used to pay taxes, there's an argument for saying the savers caused it.

Mosler: A tax liability with no gov spending = unemployment. That is "not spending" is the cause in either case. ;)

Comment: Does automation cause unemployment?

Mosler: People confuse productivity stories (automation) with unspent income stories (unemployment).

Selected Posts

Comment: Criticism of MMT is that it doesn’t apply to developing countries or those with non-reserve currency status as Frances mentions. These points have been addressed in the academic literature and at the 2017 MMT Conference by its core proponents: MMT and the Job Guarantee in Developing Countries.

Mosler: Yes, currency fluctuation doesn't per se alter real wealth. It does have serious distributional consequences, best dealt with by adjusting internal institutional structure while sustaining domestic full employment.

Comment: Agreed the so called "bleeding hearts" suddenly care more about "prices" rather then people having a productive job to shelter, feed, cloth, and educate their family with dignity. Hard to pay less for something if you don’t have a job!

Mosler: Trade deficit= a productivity increase= fiscal space to lower taxes or increase public services to sustain full employment levels of aggregate demand. Imports are real benefits, exports are real costs- the problem is the policy response that turns a good thing into a bad thing.

Comment: But that doesn't change the fact that without addressing international competitiveness, a country will be constrained to follow lower growth rate vs if it imported less/exporting more.

Mosler: The real limit to domestic output is the number of available domestic workers and their productivity. With floating fx, aggregate demand constraints are about fiscal balance/public policy which can be continuously adjusted to sustain full employment, etc.

Comment: What about balance of payments constraints?

Mosler: Thanks. There is never a case where trade issues would force the abandonment of full employment policy/optimizing domestic output of real wealth.

Posts in chronological order

Mosler: The full employment response to unspent income by any sector is lower taxes or higher public spending!

Mosler: Ironically, the $10trillion Trump tax plan deficits, denounced by both sides, are what make it work to restore output and employment.

Comment: Using Fiscal Policy to Drive Trade Rebalancing Turns Out To Be Hard.

Mosler: Use fiscal policy to sustain full employment and a gov funded transition job- then optimize real terms of trade.

Mosler: The state sets the policy rate at 0 and offers a state funded transition job to all takers to both facilitate the transition from unemployment to private sector employment and enhance price stability, and adjusts fiscal balance to minimize the number of transition workers.

Comment: Fifty-two percent of American support a federal #JobGuarantee, even more so if those jobs help mitigate and adapt to #ClimateChange. Sixty-six percent support Green New Deal-style proposals."

Mosler: I see those jobs as "standard" Gov jobs with standard federal pay and benefits etc. The JG isn't meant to replace/undermine "normal" Gov employment.

Selected Posts

Comment: One thing I like about the Job Guarantee debate is that it represents an ideological evolution beyond the internet-standard MMT debate. It's like, ok, everyone agrees that popular notions of fiscal constraints are wrong. But now that we know that, what should we spend money on?

Mosler: The real gross cost to others of the job guarantee is the increase in real consumption of the participants which is most likely to be trivial.

Comment: Market Power, Low Productivity, and Lagging Wages: The Real Drivers: To understand labor productivity—and growing inequality—you have to look at the “dual economy”.

Mosler: Again, the 'labor market' is not a 'fair game', as people need to 'work to eat' while employers only hire if they like the 'profit prospects', so without some sort of 'support', real wages tend to gravitate toward subsistence levels.

Mosler: Historically support for labor has come from unions, minimum wage laws, etc. Currently I prefer using the JG (transition job) to support wages and introduce benefits from the bottom up, along with 'high demand' fiscal policy to minimize the number of JG workers.

Comment: The economy is not a closed loop. Global capitalism has lifted millions of people from poverty around the world, and continues to do so by creating jobs in manufacturing. Profits from re-exporting these products funds new jobs.

Mosler: Jobs are the real costs. It is real consumption of real output that ultimately defines poverty and the standard of living.

Comment: Again, price stability of what? Because if you're not counting everything that money can be spent on, then you're not quantifying the real consequences of money creation.

Mosler: In a market economy, you only need to set one price and let the rest reflect relative value. That's what the JG wage does and my point is that it does it better than unemployment

Posts in chronological order

Mosler: Jobs are real costs of production, not benefits!!!

Comment: MMT is a perspective and Job Guarantee is a policy proposal. MMT doesn't force people into anything apart from changing the way they view and describe the monetary system.

Mosler: Unemployment and the JG are Govs policy responses to those that its tax has shifted from the private sector.

Mosler: In combo with full coverage Medicare4all, free public education, a full JG, narrow banking, $2,500/mo. minimum social security, etc. it's deflationary, and more than doubles the real standard of living of the "bottom" 50%..

Mosler: Assuming Gov is fully provisioned, it can 'correct its mistake' by lowering the tax until they return to the private sector. The JG promotes that transition from unemployment to private sector employment because employers don't like to hire the unemployed, etc. etc.

Comment: Warren, @wbmosler, how important is the survival of private sector from this monumental shock, for the good of economy? Private sector is an integral part, isn't it?

Mosler: Yes. And in an institutional framework that directs it towards serving public purpose.

Mosler: Yes to rebuilding desired infrastructure, but always efficiently which means a minimum of jobs as jobs are real costs for an economy, and regardless of what the policy interest rate is.

Selected Posts

Comment: Warren - recently you circulated a white paper draft where you suggested abolishing all individual and corporate income taxes - doesn't that conflict with your previous writings that it is the taxes, and our obligation to pay them in dollars, that defines the currency?

Mosler: All 'replaced' by a real estate tax.

Comment: Tariffs are killing the global economy, with no pushback from the free trade Republicans or the opposing Democrats who also believe China is the 'bad guy'. Sadly, it reminds me of a child's game we called 'who can touch the softest.'

Mosler: I'm at a loss as to how to get the word out to stop this massive slow motion train wreck. :(

Mosler: This is THE problem: "President Trump has the strong support of the American public when it comes to standing up to China," Mark Penn, co-director of the Harvard CAPS/Harris Poll survey, said.

Mosler: Far more effective and constructive to first change the institutional structure that's the open spigot that's providing the excessive incomes and wealth.

Comment: What do you recommend here other than eliminating T-bonds?

Mosler: Narrow banking, Eliminate equity ownership for fed insured pensions, JG with living (real) wage/benefits, Campaign finance reform- (say) 40% of donations go to the opposition, Eliminate private jet travel, Corporate governance reform, Just getting started!!!!

Comment: Question: What do people mean by "capital flight" in this context? They can't mean the departure of paper money (which is replaceable at zero cost). Do they mean the departure of human capital (w/ no scope of importing their brilliant services produced from abroad)?

Mosler: It's generally about selling dollars and buying FX, often via selling US financial and real assets and selling the dollar proceeds to buy FX denominated assets. The first order consequences are a falling dollar and deflationary price pressures, as indifference levels shift

Posts in chronological order

Mosler: Health Care bill looks to make a problematic system worse. Tax now and don't spend until 2014 is a 3 year drag on the economy.

Comment: BOE: Banks create most of the money in the modern economy - Quarterly Bulletin article.

Mosler: Bank loans (assets) 'create' all bank deposits (liabilities).

Comment: When a national government curbs spending on public purpose initiatives because the domestic economy can no longer absorb deficit spending, that is not austerity. Austerity is when the national government deliberately sets out to wear the people down through attrition, severely limiting their ability to obtain the currency necessary to meet the basic living needs of the people, whilst the government redirects its spending power and relinquishes its control over public services to a small handful of private entities, thereby handing over to those entities greater control over the nation's real resources and as a result of that, greater profits. In other words, austerity is the deliberate shift of fiscal policy with malice aforethought, away from the public purpose. It is violence.

Mosler: The purpose is most often to support exporters at the real expense of the macro economy. President Obama: "...to consume less and produce more; to import less and export more.” And he puts GE's Jeff Immelt in charge... :(

Comment: Fiona is right. The old lie that there isn't any money has been exploded. We can do what, as a society, we want to do. It will just take decency and hard work.

Mosler: The Gov's purchasing power= what's offered for sale in exchange for units of that currency.

Comment: Jerome Powell, Chair of the Federal Reserve, explaining why the US government will never go bankrupt in a 60 minutes Interview on Sunday. "As the central bank, we have the ability to create money". This completely destroy the arguments for "austerity" and "fiscal responsibility".

Mosler: I met Scott Pelley maybe 10 years ago in Ct. and told him how much we all appreciated his identical exchange with then Chairman Bernanke. Thanks again Scott!!!

More works of Mosler

| Banking Presentation October 11 |

| Economia Europa e moneta unicaquali scenari-Udine presentation |

| Emerging Markets and Decadence of European Model-Zurich Presentation |

| A Framework for the Analysis of the Price Level and Inflation |

| Full-Employment-AND-Price-Stability |

| Maximising Price Stability in a Monetary Economy |

| Seven Deadly Innocent Frauds of Economic Policy |

About

Warren B Mosler

“One of the brightest minds in finance.” CNBC (6/11/10)

Rajendra Rasu

“... finding answer to the economic problems"

Contact

MMT India

Chennai

Email:

warren.mosler@gmail.com

rraj1959@gmail.com